In recent years, the Italian government has introduced a series of tax incentives aimed at attracting professionals, skilled individuals, and capital from abroad. These incentives target various categories of individuals who move their tax residence to Italy, offering significant reductions of taxable income on specific types of earnings.

Below you can find a selection of information dedicated to those who intend to move to Emilia-Romagna after living abroad and to companies that want to hire professionals from abroad.

Companies

Are you a company hiring a professional from abroad and need assistance with visas or procedures, or clarification on available tax incentives?

Fill out the form to request a free one-on-one meeting with experienced experts who will provide you with personalized support.

In addition, here you can find a guide for businesses which will provide you with information on the legal, fiscal and administrative tools that facilitate the hiring of Emilia-Romagna residents abroad and of foreign citizens, both EU and non-EU, who intend to move to Italy to work permanently.

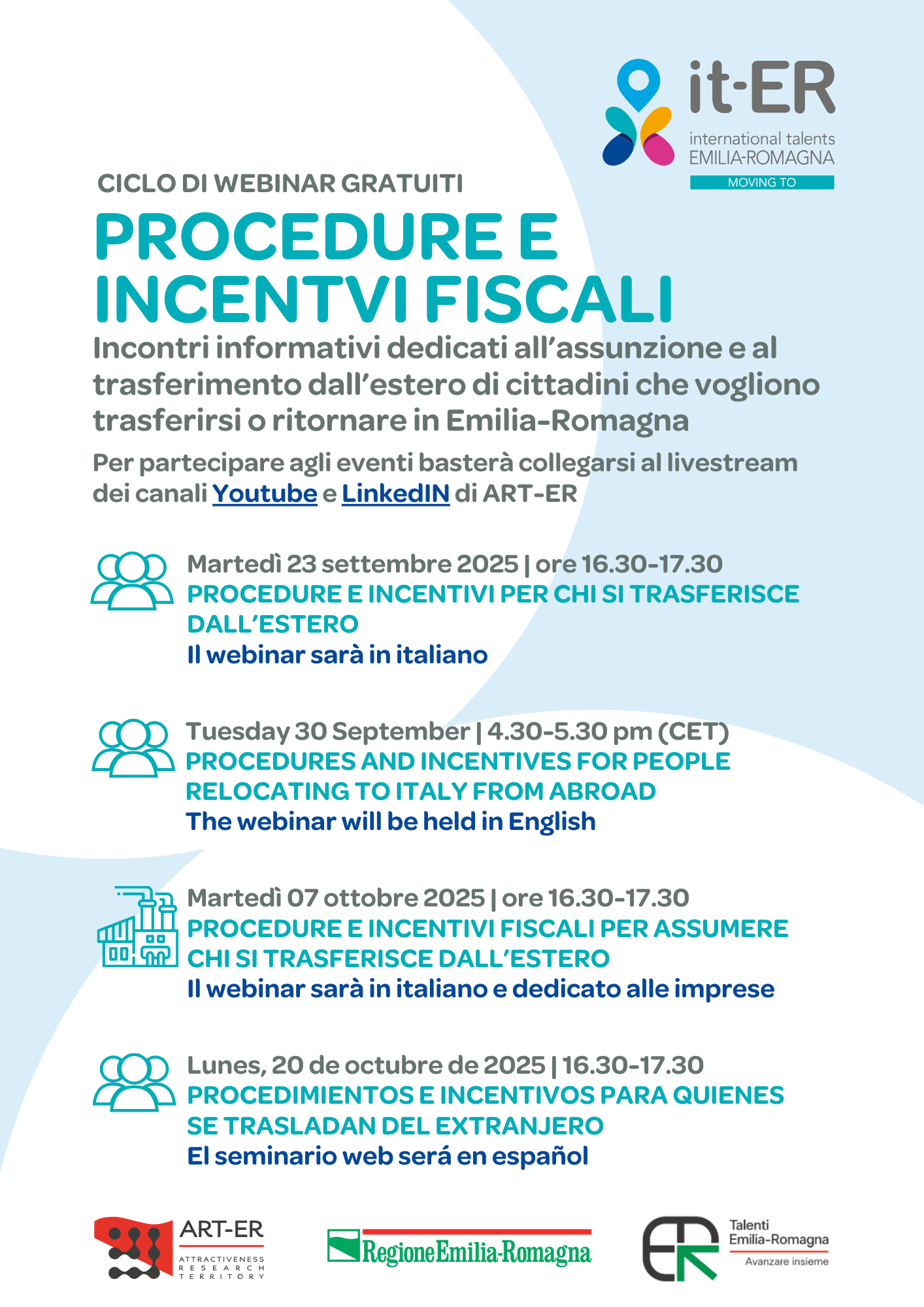

If you prefer, you can listen to the related webinar instead.

These tools are designed to provide clear and practical information on the administrative procedures to be followed for the hiring of non-EU foreign citizens, including visas, residence permits, and the tax incentives provided for the return of Italian workers from abroad, such as the scheme for inbound workers, benefits for professors and researchers, and other benefits linked to the transfer of residence to Italy.

Qualified workers

Are you a qualified worker who lives abroad interested in the opportunities offered by the Emilia-Romagna region? Here you can find a guide in Italian, English and Spanish to get all the information on the incentives and the procedures to follow in order to move or return to Italy.

If you prefer, you can listen to the related webinars in Italian, English, and Spanish.

These guides and webinars are addressed to people from the Emilia-Romagna region who reside abroad, to EU or extra-EU foreign citizens and their families who want to relocate to Italy. They support citizens in understanding and using the legal, fiscal, and administrative tools that facilitate the return of residents from Emilia-Romagna living abroad, as well as foreign citizens, whether from EU or non-EU countries, who intend to move to Italy for stable employment. They provide information on the administrative procedures to be followed for the transfer of non-EU foreign nationals. This includes visas, residence permits, and the tax incentives provided for the return of Italian workers from abroad, such as the scheme for inbound workers, benefits for professors and researchers, and other advantages linked to the transfer of residence to Italy.